Introduction to Ada

Ada is the native cryptocurrency of the Cardano blockchain platform. Named after Ada Lovelace, the world’s first computer programmer, Ada represents a new era in the digital currency space. Cardano, often referred to as the “Ethereum killer,” is a third – generation blockchain that aims to provide a more secure, scalable, and sustainable platform for the development of decentralized applications (dApps) and smart contracts. ada price serves as the fuel for all transactions and operations within the Cardano ecosystem.

The development of Cardano and Ada is based on a scientific and research – driven approach. The Cardano team consists of leading academics, mathematicians, and blockchain experts. This has led to a highly sophisticated and well – designed blockchain architecture, which in turn gives Ada a unique position in the cryptocurrency market.

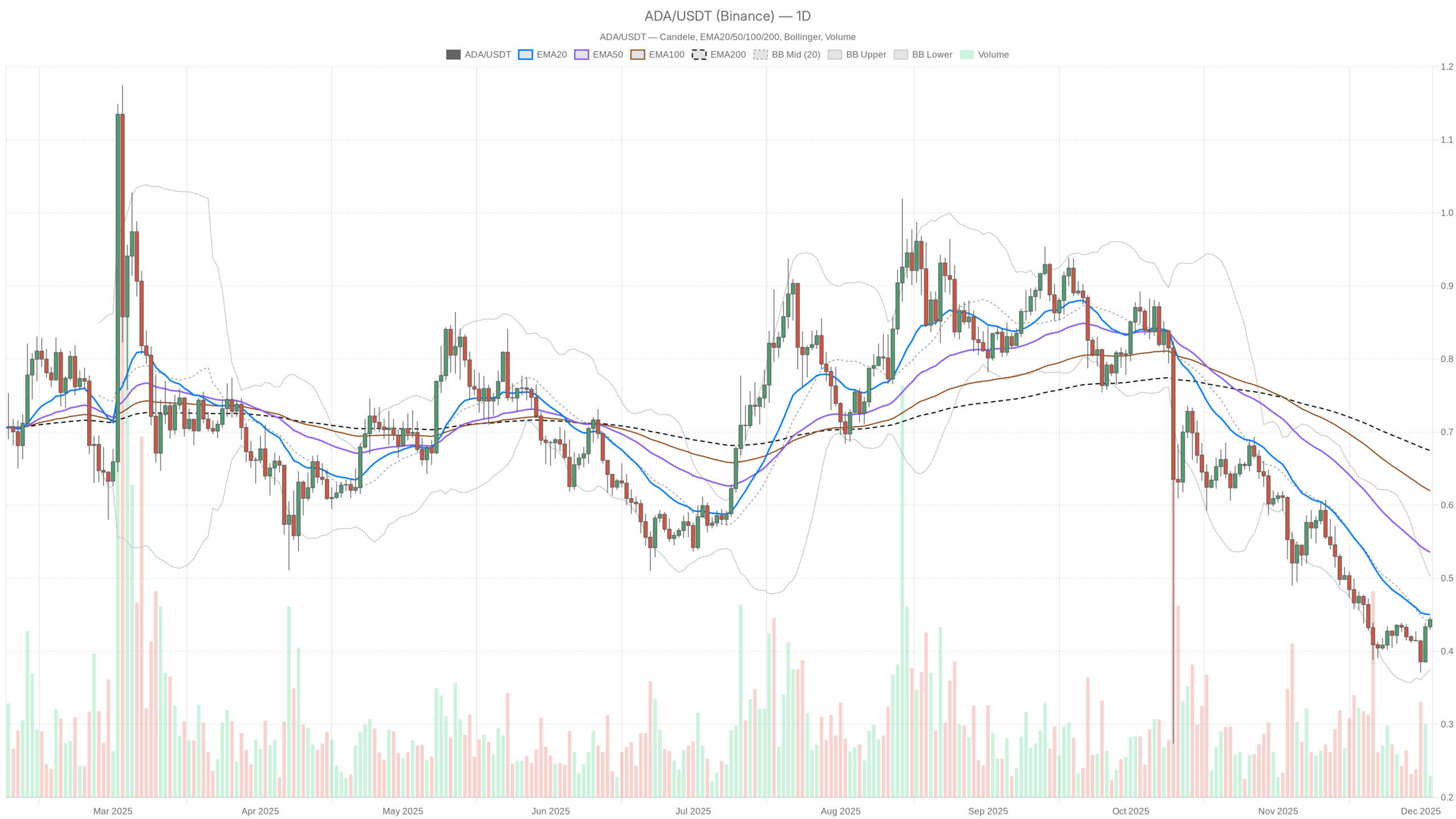

Price History of Ada

The price history of Ada is a roller – coaster ride. When it was first launched in 2017, Ada started at a relatively low price. In its early days, the cryptocurrency market was still in its infancy, and there was limited awareness and adoption of Cardano. As a result, Ada’s price remained fairly stagnant for a while.

However, as the Cardano project progressed and more features were added to the platform, Ada began to attract more attention. In 2021, the cryptocurrency market experienced a major bull run, and Ada was no exception. Its price soared to an all – time high, reaching levels that were many times its initial value. This increase was driven by several factors, including the growing popularity of decentralized finance (DeFi), the expansion of the Cardano ecosystem, and positive sentiment among investors.

After the 2021 bull run, the market entered a bearish phase, and Ada’s price declined significantly. This was in line with the overall trend in the cryptocurrency market, as many digital assets faced price corrections due to factors such as regulatory uncertainties, macroeconomic conditions, and increased competition.

Factors Affecting Ada Price

Market Sentiment

Market sentiment plays a crucial role in determining Ada’s price. Positive news about Cardano, such as the launch of new dApps on the platform, partnerships with major companies, or successful protocol upgrades, can boost investor confidence and lead to an increase in demand for Ada. Conversely, negative news, such as security breaches, regulatory crackdowns, or technical issues, can cause investors to sell their Ada holdings, resulting in a price drop.

Competition

The cryptocurrency market is highly competitive, and Ada faces competition from other major cryptocurrencies like Bitcoin and Ethereum, as well as emerging altcoins. If a competing blockchain platform offers better features, scalability, or security, it may attract users and investors away from Cardano, putting downward pressure on Ada’s price.

Regulatory Environment

Regulatory developments around the world have a significant impact on Ada’s price. Governments and regulatory bodies are increasingly taking an interest in the cryptocurrency space. Favorable regulations, such as clear guidelines for cryptocurrency trading and use, can encourage more institutional and retail investors to enter the market, driving up Ada’s price. On the other hand, strict regulations or bans can have the opposite effect.

Technological Advancements

The technological progress of the Cardano platform directly affects Ada’s price. Successful implementation of new features, such as improved smart contract capabilities, enhanced scalability solutions, or better privacy features, can make Cardano more attractive to developers and users. This, in turn, can increase the demand for Ada and drive up its price.

Price Prediction for Ada

Predicting the price of Ada is a challenging task due to the high volatility and complexity of the cryptocurrency market. Some analysts are optimistic about Ada’s future, citing the continuous development of the Cardano ecosystem, its potential in the DeFi and non – fungible token (NFT) sectors, and its scientific approach to blockchain technology. They believe that as more use cases are developed and the platform gains wider adoption, Ada’s price could reach new heights.

However, other analysts are more cautious. They point out the uncertainties in the regulatory environment, the intense competition in the cryptocurrency market, and the potential for technological disruptions. They suggest that Ada’s price may continue to be volatile in the short – term and that significant price increases may be limited until these issues are resolved.

Conclusion

Ada is a cryptocurrency with a lot of potential. Its association with the Cardano platform, which is known for its scientific and research – driven development, gives it a unique edge in the market. The price of Ada has experienced significant fluctuations over the years, influenced by a variety of factors such as market sentiment, competition, regulatory environment, and technological advancements.

While predicting Ada’s price is difficult, the future of Cardano and Ada looks promising. As the platform continues to evolve and expand, and as the cryptocurrency market matures, Ada may play an increasingly important role in the digital economy. Investors and enthusiasts should keep a close eye on the developments in the Cardano ecosystem and the broader cryptocurrency market to make informed decisions about Ada.